PROPERTY TAX

Tax collectors’ fees questioned

DeKalb, Fulton officials’ salaries inflated by supplemental charges.

By Mark Niesse mark.niesse@ajc.com

When Irvin Johnson took over as tax collector in DeKalb County last year, he became Georgia’s second-highest-paid elected official.

His compensation of $285,781, inflated by fees charged to 10 cities for preparing their residents’ property tax bills, is more than that received by state Supreme Court justices ($171,404), Gov. Nathan Deal ($139,339) and Attorney General Chris Carr ($139,169).

Among the state’s elected officials, Johnson’s pay trails only Fulton County Tax Commissioner Arthur Ferdinand, who earned about $390,000 last year — in large part because of similar direct payments from the county’s cities.

Though the arrangement isn’t new, DeKalb commissioners say it’s unusual enough to warrant another look now that the county has a new tax commissioner.

“We should review the contracts,” said Kathie Gannon, the DeKalb Board of Commissioners’ presiding officer. “The cost of the service is what we need to charge. It’s a new time and a new day.”

When DeKalb Tax Commissioner Claudia Lawson took office 10 years ago, she negotiated her fees for generating tax bills for city residents. She retired Dec. 31, 2015.

Johnson has been receiving the same fees since he took office in January 2016, though Lawson’s name is still on the contracts with the cities. Every city in DeKalb except Decatur, which has its own tax office, relies on the county for property tax administration.

On top of Johnson’s $173,000 base salary, he receives nearly $113,000 in payments from cities. That’s $2 per parcel except in the county’s three largest cities, which pay a $25,000 flat rate.

The contracts were negotiated between the cities and the county, and they automatically renew each year unless either party terminates the agreement.

Commissioner Greg Adams agreed that the board should revisit the issue.

“It’s something we would take a look into and see how it should be properly disbursed,” Adams said.

Johnson declined to comment. His staff members referred to his statements before last year’s election, when Johnson won a four-year term.

“The pay tells you it’s a little more than an administrative job,” Johnson said in a May 2016 interview. “If we don’t follow the law in terms of collecting and distributing money, it’s a serious legal matter. Somebody could go to jail.”

While some other tax commissioners in Georgia collect fees from cities for handling their taxes, not all do. Tax commissioners in Gwinnett and Cobb counties don’t receive salary supplements from cities.

In Gwinnett, eight cities contracted with the county to pay $100,407 this year for tax and fee collections, but that money goes to the county, not the tax commissioner, for the cost of printing bills, postage, accounting and customer service. In Cobb, cities send out their own tax bills, so no payments are made to the county.

Cities save money by working with county tax offices rather than setting up their own municipal tax departments, said Dan Ray, executive director for the Georgia Association of Tax Officials.

Tax commissioners deserve compensation for the job of handling so much of the public’s money — more than $2 billion a year in DeKalb and Fulton combined, Ray said.

“That’s a boatload of money, and that’s a responsibility and liability that somebody should be compensated for,” Ray said. “I’m going to argue that they’re worth it. They’re taking on a huge responsibility.”

Ray said a tax commissioner could face criminal charges if public money went missing from his office.

“It’s almost like a salary,” said Jackson County Tax Commissioner Candace Taylor, who receives $7,000 a year from four cities for their tax bills and then gives about $2,700 of that amount to her nine-person staff as a bonus. “Cities rely on our knowledge to prepare their tax bills. They have the option to do it themselves if they choose to.”

State legislators have tried to crack down on side payments to tax commissioners, with limited success.

The Georgia General Assembly passed a bill this year that eliminates a 50-cent fee that Ferdinand collected every time he sold a tax lien. That fee added up to between $22,000 to $31,000 extra per year to Ferdinand.

He still receives $1-per-parcel payments from the cities of Atlanta, Sandy Springs and Johns Creek to do their property tax bills, for a total of $210,281 last year. Atlanta paid him the largest amount: $152,865.

Ferdinand didn’t respond to emailed questions.

The city of Atlanta pays much more than other cities to both Fulton and DeKalb’s tax offices. The city pays DeKalb a total of $100,000, with $25,000 of that amount going to Johnson. That’s an expense to Atlanta taxpayers of $7 for each of the city’s 14,148 parcels in DeKalb. No other city in the county pays more than $2.43 per parcel.

Atlanta paid nearly $1.9 million to Ferdinand and Fulton’s tax office last fiscal year, according to a city spokeswoman. That comes to $12.40 per parcel.

Atlanta Councilwoman Felicia Moore said state action might be needed to rein in the city’s spending on tax billing and collection.

“If there is an effort or will to change that, the state law really needs to be changed so tax commissioners can’t charge it,” Moore said. “As long as the law allows it to occur, I suspect it will.”

The payments to the tax commissioner are negotiated by Atlanta Mayor Kasim Reed’s office and approved by the City Council.

A spokeswoman for Reed declined to comment when asked whether Atlanta taxpayers are getting a good deal.

When Irvin Johnson took over as tax collector in DeKalb County last year, he became Georgia’s second-highest-paid elected official.

His compensation of $285,781, inflated by fees charged to 10 cities for preparing their residents’ property tax bills, is more than that received by state Supreme Court justices ($171,404), Gov. Nathan Deal ($139,339) and Attorney General Chris Carr ($139,169).

Among the state’s elected officials, Johnson’s pay trails only Fulton County Tax Commissioner Arthur Ferdinand, who earned about $390,000 last year — in large part because of similar direct payments from the county’s cities.

Though the arrangement isn’t new, DeKalb commissioners say it’s unusual enough to warrant another look now that the county has a new tax commissioner.

“We should review the contracts,” said Kathie Gannon, the DeKalb Board of Commissioners’ presiding officer. “The cost of the service is what we need to charge. It’s a new time and a new day.”

When DeKalb Tax Commissioner Claudia Lawson took office 10 years ago, she negotiated her fees for generating tax bills for city residents. She retired Dec. 31, 2015.

Johnson has been receiving the same fees since he took office in January 2016, though Lawson’s name is still on the contracts with the cities. Every city in DeKalb except Decatur, which has its own tax office, relies on the county for property tax administration.

On top of Johnson’s $173,000 base salary, he receives nearly $113,000 in payments from cities. That’s $2 per parcel except in the county’s three largest cities, which pay a $25,000 flat rate.

The contracts were negotiated between the cities and the county, and they automatically renew each year unless either party terminates the agreement.

Commissioner Greg Adams agreed that the board should revisit the issue.

“It’s something we would take a look into and see how it should be properly disbursed,” Adams said.

Johnson declined to comment. His staff members referred to his statements before last year’s election, when Johnson won a four-year term.

“The pay tells you it’s a little more than an administrative job,” Johnson said in a May 2016 interview. “If we don’t follow the law in terms of collecting and distributing money, it’s a serious legal matter. Somebody could go to jail.”

While some other tax commissioners in Georgia collect fees from cities for handling their taxes, not all do. Tax commissioners in Gwinnett and Cobb counties don’t receive salary supplements from cities.

In Gwinnett, eight cities contracted with the county to pay $100,407 this year for tax and fee collections, but that money goes to the county, not the tax commissioner, for the cost of printing bills, postage, accounting and customer service. In Cobb, cities send out their own tax bills, so no payments are made to the county.

Cities save money by working with county tax offices rather than setting up their own municipal tax departments, said Dan Ray, executive director for the Georgia Association of Tax Officials.

Tax commissioners deserve compensation for the job of handling so much of the public’s money — more than $2 billion a year in DeKalb and Fulton combined, Ray said.

“That’s a boatload of money, and that’s a responsibility and liability that somebody should be compensated for,” Ray said. “I’m going to argue that they’re worth it. They’re taking on a huge responsibility.”

Ray said a tax commissioner could face criminal charges if public money went missing from his office.

“It’s almost like a salary,” said Jackson County Tax Commissioner Candace Taylor, who receives $7,000 a year from four cities for their tax bills and then gives about $2,700 of that amount to her nine-person staff as a bonus. “Cities rely on our knowledge to prepare their tax bills. They have the option to do it themselves if they choose to.”

State legislators have tried to crack down on side payments to tax commissioners, with limited success.

The Georgia General Assembly passed a bill this year that eliminates a 50-cent fee that Ferdinand collected every time he sold a tax lien. That fee added up to between $22,000 to $31,000 extra per year to Ferdinand.

He still receives $1-per-parcel payments from the cities of Atlanta, Sandy Springs and Johns Creek to do their property tax bills, for a total of $210,281 last year. Atlanta paid him the largest amount: $152,865.

Ferdinand didn’t respond to emailed questions.

The city of Atlanta pays much more than other cities to both Fulton and DeKalb’s tax offices. The city pays DeKalb a total of $100,000, with $25,000 of that amount going to Johnson. That’s an expense to Atlanta taxpayers of $7 for each of the city’s 14,148 parcels in DeKalb. No other city in the county pays more than $2.43 per parcel.

Atlanta paid nearly $1.9 million to Ferdinand and Fulton’s tax office last fiscal year, according to a city spokeswoman. That comes to $12.40 per parcel.

Atlanta Councilwoman Felicia Moore said state action might be needed to rein in the city’s spending on tax billing and collection.

“If there is an effort or will to change that, the state law really needs to be changed so tax commissioners can’t charge it,” Moore said. “As long as the law allows it to occur, I suspect it will.”

The payments to the tax commissioner are negotiated by Atlanta Mayor Kasim Reed’s office and approved by the City Council.

A spokeswoman for Reed declined to comment when asked whether Atlanta taxpayers are getting a good deal.

------------------------------------------------

7/25/15

Ethically challenged Fulton Tax Commissioner Ferdinand has been absent from the news recently, now he is back with the below long running civil suit. It is said that if you look up 'crook' in a dictionary they have a photo of Ferdinand next to the entry. Below is the latest AJC report on this guy.

And one final matter, the AJC and Ferdinand have had a long running war with Ferdinand slapping a lien on any Cox property in Fulton if they miss paying a tax by even a day (the AJC is a Cox newspaper) and the AJC runs articles on Ferdinand whenever they find an opportunity to take a shot at him. A good summary is that Ferdinand is a first class sleezeball and deserves all the bad press he gets.

YOUR TAX DOLLARS

Lawsuit has cost Fulton $137K

Tax commissioner accused of abuse of power; deal is likely.

A lawsuit accusing Tax Commissioner Arthur Ferdinand of abuse of power has cost Fulton County nearly $137,000, and the final price tag might be higher.-----------------------------------------------------------------------------------------------------

9/23/14

Fulton issues back on agenda

9/23/14 Atlanta Journal Constitution

Legislative delegation discusses tax breaks, cityhood, tax liens.

Big tax breaks for homeowners, a new city in south Fulton County and curbs on the Tax Commissioner Arthur Ferdinand’s ability to profit from tax liens will be back on the General Assembly’s agenda in 2015.

------------------------------------------------------------------------

June 21, 2014 from the AJC

Tax chief loses in court

Judge refuses to dismiss abuse-of-authority lawsuit.

A Fulton County judge has rejected Tax Commissioner Arthur Ferdinand’s request to dismiss a lawsuit that accuses him of abusing his authority.

----------------------------------

Note: This issue has other relevant posts further down the blog. Put the term 'Hausmann' into the 'search' bar at the top of the blog to bring up these posts.

==================================================================

April 7, 2014

FULTON COUNTY

Tax chief changes position in dispute

Commissioner says probe was political payback.

Fulton County Tax Commissioner Arthur Ferdinand has changed his story on why he investigated the residency of a county commissioner last year and suggested she no longer lived in her district.

DIGGING DEEPER

3/24/14

Tax chief gets to keep profits

Bill to rein in Fulton’s Ferdinand dies again in legislative session.

Another year and more complaints about Fulton County Tax Commissioner Arthur Ferdinand didn’t make much difference in the General Assembly, where legislation to change the way he handles late property tax bills once again died.

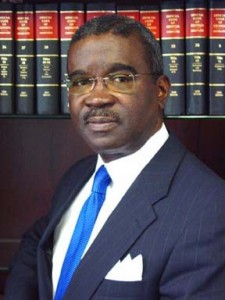

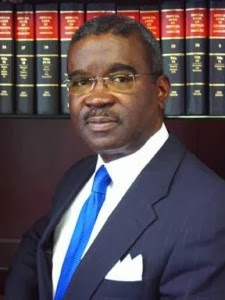

Fulton County Tax Commissioner Arthur Ferdinand

---------------------------------------------------------------------

March 4, 2014 - The AJC Reports in Today's edition:

METRO ATLANTA

Measure targets fee collected by tax chief

Legislation to stop Fulton County’s tax collector from personally profiting off tax debts moved from the House to the Senate on Monday. House Bill 819 passed 173-1.

An investigation by The Atlanta Journal-Constitution last year found that Tax Commissioner Arthur Ferdinand has been using an old law to collect 50 cents every time he sells a tax lien to a private collector or a property owner pays off a lien on his own — amounting to tens of thousands of dollars per year. The practice, initially done without the County Commission’s knowledge, has boosted Ferdinand’s annual pay to about $383,000 — by far the highest compensation for any elected official in Georgia.

“It’s paying someone for not doing their job,” said the bill’s sponsor, Rep. Chuck Martin, RAlpharetta.

The bill would also require tax commissioners to try to find a taxpayer through Internet searches and people-finder databases, among other records, to make sure he is notified before the county sells a lien against his property.

--------------------------------------------------------------------------------------------------

March 1, 2014 - AJC AT THE GOLD DOME

Bill to protect homeowners stalls in House

Fulton County tax chief’s lien policy called a major conflict of interest.

Legislation to protect homeowners and stop Fulton County’s tax chief from profiting off their debts could go belly up this session, just as similar proposals have done in past years.

House Bill 819 seeks to keep bill collectors from profiting off late taxes that property owners may not know they owe. It also would keep Fulton County Tax Commissioner Arthur Ferdinand from pocketing 50 cents every time he sells a delinquent tax bill or a taxpayer settles a lien.

But the bill has already been weakened as a result of heavy lobbying by Vesta Holdings, whose network of companies buys most of Fulton’s tax liens. And with crossover day looming Monday — the deadline for a bill to pass from one chamber of the state Legislature to the other — the measure hasn’t been approved and isn’t scheduled for a floor debate.

The bill’s backers, mostly north Fulton Republicans, said they are confident they can move it on to the Senate and make revisions later. Even after crossover day, lawmakers can maneuver and horse trade to get language added to other bills.

“The path taken by a bill from beginning to end has many turns in it,” said Rep. Wendell Willard, R-Sandy Springs, who has tried repeatedly to curb Ferdinand’s practices and beef up taxpayers’ rights.

Provisions in HB 819 were proposed to end practices exposed in several investigations by The Atlanta Journal-Constitution.

One investigation last year found that Ferdinand is apparently the only Georgia tax commissioner using an old state law to personally collect 50 cents every time a tax lien gets paid. As a result, the state’s highest-paid elected official has been pocketing roughly $22,000 to $31,000 extra per year, boosting his pay to about $383,000.

Ferdinand did not respond to a request for comment about this story.

In its original form, HB 819 also would have prevented Vesta and other companies from turning a quick 10-percent profit when a tax bill is 90 days late.

Last year, the AJC discovered that Ferdinand’s quick sales of delinquent bills — before the penalty kicked in — resulted in the loss of millions of dollars in potential county revenue from late fees. Over an 11-year period, the county handed as much as $20 million in potential profits to Vesta, with a corresponding $20 million potential loss to taxpayers.

In some cases, Ferdinand sold the bills a day or two before the penalty would have applied.

Vesta representatives argued in committee meetings that loss of the 10-percent fees would undermine its profit incentive, causing small bills to go uncollected, forcing the county to foreclose on homeowners and slowing revenue collections for cities, school systems and the county.

The bill’s chief sponsor, Rep. Chuck Martin, R-Alpharetta, removed that provision, saying changes must be made to how the penalty applies and which governments would be able to keep it.

“Some of the representatives sitting there were torn,” said Dan Ray, executive director of the Georgia Association of Tax Officials, “because they represent some of those cities and school systems.”

A lobbyist for InVesta Services — one of Vesta’s associated companies

— said lawmakers thought better than to create problems for local governments just to enrich Fulton County with the 10 percent penalty.

“These local governments only stand to lose waiting on delinquent taxpayers to pay up,” lobbyist John Walraven said in a written statement.

That speaks to another problem with Fulton’s system that HB 819 would address.

For the past three years, the AJC has reported how residents have nearly lost their homes because of tax bills they claim they never received.

If taxpayers don’t know about the debts, the collection firm racks up more interest, and it can eventually auction a home to settle the debt.

If taxpayers don’t know about the debts, the collection firm racks up more interest, and it can eventually auction a home to settle the debt.

The House bill would require tax commissioners to try to find taxpayers through Internet searches and people-finder databases, among other records, before selling a lien.

The current process, if nothing else, creates plenty of ill will toward the county. Condominium owner Robert Lynn said he had to pay InVesta about $500 to get rid of liens. He said he didn’t know he had more to pay after dropping his tax appeal, and he would have appreciated a certified letter telling him.

“My perception is that they relish the opportunity to take advantage of people, through the technical, legal setup the way it is now,” Lynn said. “I think they actually look forward to people like me, and then it’s like, ‘OK. We got one, we got one, we got one.’”

Ferdinand sells more liens than any other commissioner in the state, a practice he has defended as a guaranteed way to boost collections. Other counties that do not sell liens boast similar collection rates, but they take longer to reach them.

The tax chief has said repeatedly that privatized collections don’t harm taxpayers because they owe the same sum in taxes, penalties and interest either way. He has also pointed out that private investors, unlike counties, must wait a year to foreclose.

However, an AJC investigation found that, through so-called “super liens,” some lien buyers have been able to circumvent legal safeguards to quickly foreclose on homes and pocket the equity.

Martin, the state lawmaker, said he’s looking for a way that both lien-buyers and local governments and school systems can collect penalty fees.

He also said liens might be better sold through a bid system. Currently, the tax commissioner may sell liens to whomever he wishes, and some investors have complained of favoritism for Vesta.

“I think open, honest competition for this business, if there’s a business of collecting these fees, is not a bad thing,” Martin said. “We’ve got a little bit of an upside down, inverse business model here. You collect more if you don’t try to collect.”

Staff Writer Aaron Gould Sheinin contributed to this article.

AJC watchdog coverage

The Atlanta Journal-Constitution has covered an array of issues involving the Fulton County Tax Commissioner’s Office, including its sales of tax debts to private collection firms and tax chief Arthur Ferdinand’s take-home pay.-----------------------------------------------------------------------------

Fulton tax chief: No favors

for Reed

By

Johnny Edwards jredwards@ajc.com

Fulton County’s tax

chief won’t face an ethics investigation for allegedly giving special treatment

to Atlanta Mayor Kasim Reed on late taxes, thanks in part to uncashed cashier’s

checks the tax commissioner produced for the first time Tuesday.

It was yet another

shift in the official story of why Reed owed tens of thousands of dollars in

delinquent property taxes soon after taking office. For the first time, Tax

Commissioner Arthur Ferdinand offered a public explanation as to why Reed

received drastically different treatment than ordinary taxpayers.

The latest: Reed sent

in a cashier’s check for $21,476 in taxes that his company owed on a

warehouse and a vacant lot, but the tax office never cashed it. The same

happened with another check for $2,200, but it is unclear what that check was

for.

Ferdinand handed copies

of the two checks to the county’s Board of Ethics members during a

probable-cause hearing Tuesday. The board later voted unanimously not to pursue

an investigation of the tax commissioner.

The checks were a

revelation to those following the case: although The Atlanta

Journal-Constitution filed open-records requests last year concerning Reed’s

property taxes, the records supplied to the newspaper did not contain copies of

the checks. As he left Tuesday’s hearing, Ferdinand ignored questions from an

AJC reporter about the checks.

The larger check,

Ferdinand told the ethics board, shows that Reed tried to pay his taxes on time

in October 2009.

“In those situations,

we give the taxpayers the benefit of the doubt,” Ferdinand told the board.

“Elected officials get the same treatment if they walk into my office.”

Typically, Fulton

taxpayers who fail to pay all or part of their bills have liens slapped on

their properties within months. The county may sell the liens to

investors, who then collect interest and penalties and may auction properties

to settle accounts.

When taxpayers have

complained that they weren’t properly notified, as Reed’s attorney did,

Ferdinand’s policy has been to tell them to resolve the matter by satisfying

the debt with the firm that bought it.

Ferdinand on Tuesday

offered a half-dozen examples of other taxpayers who he said received the same

treatment as Reed, but they were mostly because of errors on the county’s part,

such as exemptions not accounted for or ownership changes not documented.

The taxes in the

mayor’s case involved properties held by Cascade Investors, Reed’s real estate

partnership.

“We’re not surprised by

the outcome,” Reed spokesman Carlos Campos said. “Mayor Reed exercised his

right, as any citizen is able, to appeal an improper tax lien being placed on

the partnership’s property. He received no special treatment whatsoever, from anyone.”

In September, an

investigation by The Atlanta Journal-Constitution found that, soon after Reed

was sworn in as mayor in 2010, Ferdinand personally intervened to buy back an

$18,500 tax lien lodged against the warehouse proper ty. Vesta Holdings, a

private debt collector, had bought the debt from the county.

The AJC also found that

Reed met personally with Ferdinand in April 2010 to discuss his company’s tax

account. According to a letter from Reed’s attorney, Reed was concerned at the

time that he wasn’t receiving mailings from the tax office because it was using

an old address.

That address was his

old law firm and the firm of his current attorney, Robert Highsmith.

“It is my understanding

that Mayor Reed provided these checks to Commissioner Ferdinand when he

initially reached out the commissioner to try to resolve this issue,” Highsmith

said Tuesday, referring to the 2010 meeting.

Highsmith said he found

copies of the checks when he retrieved files from storage, after the AJC story

ran in September.

Ferdinand later took

steps to nullify all liens ever placed against Cascade Investors, filing papers

in Superior Court instructing the clerk to remove them from the record. He

cited “address change” issues, as well as “payment processed before lien was

filed.”

Rome, Ga.-based ethics

advocate George Anderson, who filed the ethics complaint after reading the AJC

article, accused Ferdinand and the board of a cover-up. “It still doesn’t wash,” he told the

board. “It doesn’t pass the smell test.”

Scrawled on the check

copies were handwritten notes saying, “Not cashed per Mayor.” Anderson

questioned where the check came from and when Ferdinand’s office received a

yellow carbon copy from Reed.

“I really don’t know,”

Tax Administrator Gladys Bradfield said in response.

The check’s discovery

leaves other questions unanswered.

Ferdinand indicated

that his office helped Reed since he may have done nothing wrong, but Reed

still wound up paying thousands of dollars in penalties and interest, plus a

fee for a bounced check.

Ferdinand has

repeatedly pointed out that debt collectors charge no more in penalties and

fees than the county would, so there’s no harm to taxpayers. Yet rather than

telling Reed to just pay off Vesta, Ferdinand pulled the lien back in to his

office. The tax chief said Tuesday that the only benefit is the taxpayer gets

to deal with his office rather than a private company.

The board didn’t appear

concerned that the checks appeared for the first time Tuesday. Asked whether

the tax office’s failure to turn them over in past records requests gave him

pause, ethics board Chairman Donald Edwards said, “To me, it fits. Everything fits

the timeline.”

Staff writer Shannon

McCaffrey contributed

to this article.

MY AJC.COM

Log on to www.MyAJC.com to learn more about tax

chief Arthur Ferdinand’s collection process.

BOB

ANDRES / AJC

IN-DEPTH REPORTING

The Atlanta Journal-Constitution broke

the story last year that Fulton County Tax Commissioner Aurthur Ferdinand

appeared to have given special treatment to Mayor Kasim Reed on Reed’s overdue

property taxes. Tuesday’s meeting of the Fulton County Ethics Board was a

direct result of that report. The news organization long ago established that

Ferdinand is the highest-paid elected official in the state. In addition to his

regular salary, the commissioner charges three cities in Fulton County $1 per

parcel for handling those cities’ tax collections. In addition he relies

heavily on selling liens for unpaid taxes to private companies — for which he

collects 50 cents per transaction. Some of the lien buyers have then used

aggressive tactics against delinquent taxpayers to collect on the debt.

Including his salary and the additional fees he collected, Ferdinand’s pay in

2013 totaled $383,000, the AJC found. In large part because of the AJC’s

reporting, Fulton legislators have proposed making Ferdinand’s position an

appointed rather than elected one, and changing the law so that tax

commissioners may not collect fees for selling their constituents’tax liens.

=======================================================================Monday, January 27, 2014

ETHICS

Reed, tax chief face ethics complaints

Advocate says mayor got special treatment.

Board to hold hearing on intervention to pay $18,500 tax lien.

--------------------------------------

Saturday, January 25, 2014

AJC AT THE GOLD DOME

Bill targets tax chief ’s profits

Fulton County official gains when delinquent tax bills sold or settled.

State lawmakers will try again this year to rein in the sale of overdue property tax bills to private collection firms, aiming to cut profits for both the Fulton County tax collector and his biggest buyer of tax liens.

Ferdinand sells more liens than any other commissioner in the state, a practice he has defended as a guaranteed way to boost collections.

Myajc.com

Read more of our coverage of his extra payments, including:

AJC WATCHDOG

=====================================================================

From the Sunday Jan 12, 2014 AJC Metro Section:

http://digital.olivesoftware.com/Olive/ODE/AtlantaJournalConstitution/

AJC WATCHDOG

Tax chief gets farm subsidies

Top-paid elected official takes public monies for property upkeep.

By Johnny Edwards jredwards@ajc.com

Fulton County’s tax collector, Georgia’s top-paid elected officeholder, has tapped another source of taxpayer money: U.S. farm bill subsidies. It’s for his cows. Along with being tax commissioner, Arthur Ferdinand raises Angus cattle in rural Chattahoochee Hills, about 30 miles southwest of downtown Atlanta.

He acquired the farm in a shabby state a decade ago, then used public funds to help spruce up his pastures, taking in tens of thousands of dollars to put up fences, install watering stations, enhance grass quality and make other improvements to an operation he calls “Chaguanas Farm,” an investigation by The Atlanta Journal-Constitution found.

The funds came through a U.S. Department of Agriculture program that encourages ecofriendly land management, and Ferdinand has been one of the metro area’s top recipients of the subsidies during the past decade, data obtained through a Freedom of Information Act request shows.

Though legal, it’s yet another way the Atlanta official has steered public money his way, even as many of his constituents struggled to pay their bills in the wake of the Great Recession.

The taxman known for his aggressive collection tactics has also used legal loopholes to pocket fees from the county and three cities, boosting his take-home pay to upwards of $380,000 per year, previous investigations by the AJC discovered. Ferdinand now earns close to triple the pay of the governor and nearly as much as the U.S. president, even though his base salary is just $134,279.

Meanwhile, he has spent thousands of county taxpayer dollars taking his highest-paid staffers on budget-planning trips to lakefront luxury lodges and dining with unidentified individuals for business lunches at posh restaurants. Last year, he spent $39,000 of his department’s funds to buy himself a take-home 2013 Ford Explorer Limited.

Ferdinand has responded that state law allows his extra compensation, and that his methods, including selling unpaid bills to private collection firms, keep the county flush with cash and tax rates low.

But incensed state lawmakers have pushed measures to stop Ferdinand from enriching himself off public office, and at least two bills targeting him are expected in next year’s legislative session.

His beef operation is modest — about 30 head of cattle on 70 acres. He apparently qualified for aid as a beginning cattleman earning less than $1 million per year.

“I’m not surprised he’s found another way to skin the cat,” said state Rep. Wendell Willard, R-Sandy Springs, Ferdinand’s foremost critic in the Legislature.

The AJC found that, since 2005, the federal government has allotted Ferdinand almost $35,000 in Environmental Quality Incentives Program, or EQIP, money — the second-most given to any farmer in Clayton, Cobb, DeKalb, Fulton and Gwinnett counties.

Some conservationists were shocked he has been a recipient and questioned the program’s priorities.

“I would prefer to tighten these things up so that farmers of need get them,” said Alan Toney, the elected chairman of the Fulton County Soil and Water Conservation District, a citizen oversight committee. “Like with any other government program, there’s things that you wish were different.”

Living a dream

Ferdinand did not respond to messages seeking information about his cattle farm or the subsidies. A call to Chaguanas was answered by his wife, Betty.

She said the government gave them the money because their farm met all the program specifications, and she advised staying away from “things you don’t understand.”

“I’ve spoken to you longer than you deserve,” she said after a brief conversation, “so I’m hanging up.”

The Ferdinands sparked controversy when they bought the property in 2003, leading to a hearing before the county’s ethics board, but no charges.

The tax chief used Tom Biggers, his delinquent-tax administrator at the time, as a middleman to buy it from Foxworthy Inc., a company that had bought millions of dollars in tax deeds from the county.

Ferdinand has said he needed Biggers’ help because, in the past, he and his wife had problems buying property in Georgia because they are black. He said his office had no involvement in the bank foreclosure auction where Fox-worthy obtained the land.

The board ruled unanimously that there wasn’t enough evidence to pursue ethics charges.

In affidavits filed in the case, the Ferdinands said they shared a dream of owning their own farm, and Betty Ferdinand said she led the search for income-producing acreage.

She described the land they chose, off Hutcheson Ferry Road, as abandoned and overgrown, with a dilapidated swimming pool and a burned-out house. They also bought an adjacent property with a house that they planned to rent out.

They named the land Chaguanas, which is the largest borough of Trinidad and Tobago, Arthur Ferdinand’s native country. Their driveway is within a few hundred yards of an entrance to south Fulton’s eco-chic Serenbe community.

They don’t live there; county records show their primary residence is in southwest Atlanta.

Saving nature or boosting production?

An online article produced by the Natural Resources Conservation Service, a branch of USDA, touts the Ferdinands’ farm as “another conservation success story.” It describes the couple spending four years clearing kudzu and brush before they could start farming.

The article says Ferdinand sought help getting started from the county extension office, which directed him to USDA.

Through EQIP, taxpayers helped turn his property around.

The federal government chipped in almost $2,800 in fencing costs, more than $1,700 for pasture and hayland planting, $3,000 for drinking stations and $3,300 for grading, graveling and soil protection, records of his earliest contract show.

Ferdinand has since been allotted another $11,000 for electric and barbed-wire fencing, $4,200 for graveling and $2,100 for cow watering.

The farm improvements allow them to rotate the cattle between grazing sections and protect the paths where the cows trod, the agency reported.

“Establishing these practices has increased the quality of grass and hay supply on their land, diminishing the need for extra additives in his cattle’s food supply,” the article said. “ ... All of these practices cut down on the daily upkeep of the land, thus lowering overall cost.”

EQIP isn’t designed to supplement farmers’ in come, but rather to keep farmers from sullying the environment, according to Craig Cox of the Environmental Working Group, a Washington research organization pushing for farm bill reform.

Like rotating crops, rotating cattle among different grazing areas cuts down on erosion, reducing sediment runoff into tributaries of the Chattahoochee. Fences and alternative water sources keep cows out of streams.

But Cox, the organization’s senior vice president over agriculture and natural resources, said the federal government shouldn’t be paying farmers to do things they ought to do anyway. Cox questions whether too much of the billions of dollars spent on EQIP since the 1990s has gone to helping farmers maximize profits, rather than solving environmental problems.

“This could have been designed to solve a problem that is worth the taxpayer investment,” Cox said of the funds for Ferdinand. “But it could have been designed to improve his pasture so he can graze more cattle, and the cattle gain more weight.”

Washington-based Citizens Against Government Waste has asked Congress to lower the income limits to $250,000 for farmers receiving commodity and conservation subsidies, to no avail.

Valerie Pickard, the USDA’s district conservationist for the metro Atlanta area, approved Ferdinand’s application based on a ranking system. She said concerns about water sources near Ferdinand’s property played into in his allocation. Some of the funds went toward fencing off a pond.

“It’s helping them to achieve their goal of having a farm,” she said, “to maintain a farm and preserve its natural resources.”

The larger picture

Willard, the state representative, said lawmakers can’t do anything about Ferdinand’s federal aid. They’ll focus instead on shrinking his power and forcing a pay cut.

One bill pending in the Senate would make the Fulton tax commissioner an appointed position starting in 2017, meaning that if Ferdinand wants to stay on after his current term ends, when he’ll be 76, he would work at the pleasure of county commissioners instead of voters.

Another measure being drafted would undo a law dating to the Great Depression, when many constitutional officers got paid through fees rather than salaries, allowing tax commissioners to collect 50 cents every time a debtor paid off a tax lien.

An AJC investigation last summer exposed how Ferdinand seized upon that law to profit off his controversial practice of selling liens to private collectors, adding about $22,000 to $31,000 per year to his annual pay.

Frank X. Moore, an attorney who has represented more than a dozen property owners pitted against debt buyers and Ferdinand’s office, said taxpayers should also be concerned about the nearly $35,000 he’s receiving for his cows.

“That’s a whole lot of money to Rita James, who gets by on $700 a month in Social Security,” he said of one client, a grandmother in her 70s who nearly lost her home because of a billing error and a lien sale. “This guy has no shame. He seems to be an expert at benefiting from government.”

“That’s a whole lot of money to Rita James, who gets by on $700 a month in Social Security,” he said of one client, a grandmother in her 70s who nearly lost her home because of a billing error and a lien sale. “This guy has no shame. He seems to be an expert at benefiting from government.”Arthur Ferdinand is Georgia’s top-paid elected officeholder, with take-home pay of $380,000.

Fulton County Tax Commissioner Arthur Ferdinand acquired the 70-acre farm off Hutcheson Ferry Road in south Fulton County about 10 years ago.

===================================

BRANT SANDERLIN / BSANDERLIN@AJC.COM

METRO ATLANTA’S TOP EQIP RECIPIENTS

An analysis of farm bill data found that of all farmers in Clayton, Cobb, DeKalb, Fulton and Gwinnett counties, Fulton County Tax Commissioner Arthur Ferdinand has received the second-highest allocation of funds during the past decade. The top five recipients:

ABOUT EQIP

› Originally authorized by the 1996 farm bill › Funded at more than $4 billion since its inception › Purpose: To help agricultural producers manage their operations in ways that protect soil, water, plant, animal and air resources, on both farmland and forestland.

› Provides financial and technical help through contracts of up to 10 years.

› EQIP contracts in Georgia totaled $13.4 million in 2011, $24.8 million in 2012 and $28.6 million this year.

› An estimated one out of every three EQIP applicants receives funding in Georgia, but no farmers have been turned down in Fulton County in the past several years because so few applied.

› Benefits are limited to individuals or entities with adjusted gross incomes of $1 million per year or less.

› Records show Fulton County Tax Commissioner Arthur Ferdinand has received four allocations: $11,543 (2005), $5,346 (2009), $3,531 (2011) and $14,188 (2013). For the 2013 contract, he has yet to receive $8,518, data shows.

SOURCE: U.S. DEPARTMENT OFAGRICULTURE LITERATURE; DATA PROVIDED

BYTHE NATURAL RESOURCES CONSERVATION SERVICE UNDER A FEDERAL

FREEDOM OF INFORMATION ACT REQUEST; FEDERAL DATA COMPILED BY

THE ENVIRONMENTALWORKING GROUP; FULTON COUNTY SOILAND WATER

CONSERVATION DISTRICT CHAIRMAN ALAN TONEY

AJC WATCHDOG COVERAGE

The Atlanta Journal-Constitution has covered an array of issues involving the Fulton County Tax Commissioner’s Office, including its sales of tax debts to private collection firms and tax chief Arthur Ferdinand’s take-home pay. Through $1-per-parcel fees charged to Atlanta, Johns Creek and Sandy Springs, Ferdinand boosts his annual pay by hundreds of thousands of dollars per year, making him the state’s highest-paid elected official.

This year, the AJC revealed how Ferdinand’s quick sales of delinquent tax bills, before the county collected a 10 percent penalty, handed as much as $20 million in potential revenues to Vesta Holdings, the biggest lien buyer, with a corresponding $20 million loss to taxpayers. The AJC also discovered that Ferdinand dipped into his budget to buy a 2013 Ford Explorer Limited for $39,000, which he can use for his commute to work.

Another investigation revealed he has been earning an extra $22,000 to $31,000 per year by taking 50 cents every time he sells a tax lien to a collector or a taxpayer pays off a lien themselves, which critics called a staggering conflict of interest.

Then the AJC revealed Ferdinand personally intervened after a tax debt owed by Atlanta Mayor Kasim Reed’s real estate holding company, Cascade Investors, was sold to Vesta. The Tax Commissioner’s Office got the debt transferred back to the county, then later filed documents asking the Superior Court Clerk to remove all liens filed against Cascade from the record.

=================================================================== 12/11/13

Local neighborhood says Fulton Tax Commissioner is costing them millions

NBC Atlanta - 9:56 PM, Dec 10, 2013

EAST POINT, Ga. -- It is an economic success story on the southwest side of Atlanta. Anchored by the Camp Creek Marketplace, this ambitious area west of Hartsfield-Jackson Airport has quietly thrived over the last decade.

"This is a great side of town. We've got the airport here. We've got great hotels here, we've got great businesses here," said Brianna Williams, who lives in the area.

"It's just a nice place to be. We all can't live on the north side," added David Cole, another resident.

For the last seven months, property owners in this area have tried to form a community improvement district. CIDs are commonplace on the north side of town. They are self taxing and funnel extra tax money into their own district for infrastructure and other improvements. They've been unable to form that CID, they say, because the Fulton County tax commissioner has blocked it.

The tax commissioner is Arthur Ferdinand-- the elected official with the highest salary in the state. Ferdinand made $383,000 last year -- by taking his county salary, personally collecting fees on certain tax bills, and by personally collecting legal kickbacks from debt collectors.

"This by the way is taxation that I volunteered for," said Neel Shah, who owns two hotels in the proposed CID.

Neel Shah owns two hotels in the proposed district. He says seven months of foot dragging by Commissioner Ferdinand is costing his area's proposed CID millions of dollars.

"So I feel like I've lost $6.5 million or more than that - money that was going to be directed into that area, specifically for security, lighting and cleanup," Shah said.

Shah says instead, much of that money has been redirected to wealthier communities on the north side of Atlanta.

Ferdinand released a statement that said in part: "Our office is required to assure prior to certification, that each CID establishes that 50% of the property owners approve the creation of the CID and those consenting owners must own 75% of the fair market value of the properties within the proposed CID boundary.

"In vetting the ownership information of the proposed Airport West CID, we have concerns that give rise to a need for further review to assure the thresholds have been satisfied."

Shah says Ferdinand is mistaken. "They themselves admitted that we were within 100 percent compliance on our paperwork," he said.

-----------------------------------------------------------------

From: http://www.11alive.com/news/article/315551/40/Local-neighborhood-says-Fulton-Tax-Commissioner-is-costing-them-millions

http://11alive.com/

======================================================================

10/3/13

AJC WATCHDOG

Pay cut sought for tax chief

Fulton tries to curb official’s profiting from each sale of tax debt.

Another effort is brewing to cut the pay of the state’s highest-paid elected official — something frequently attempted but never accomplished.

Commissioners were unaware of the arrangement until it was exposed in an investigation by The Atlanta Journal-Constitution in August.

Ferdinand is likely the only Georgia tax chief keeping that fee, which also fattens his paycheck when delinquent taxpayers pay off a lien on their own. He has been pocketing roughly $22,000 to $31,000 extra per year. That boosted his pay last year to about $383,000 for a job where he started out earning $77,400 in 1997.

Commission Vice Chairwoman Emma Darnell, who represents the western portion of Atlanta, called the practice “citizen exploitation,” giving the tax chief a personal financial incentive to transfer more liens to profit-driven investors.

Her resolution also calls on Ferdinand to give up the practice on his own. But the measure has no binding effect. And while the commission sets the budget for the tax commissioner’s office, it otherwise has no authority over a fellow elected official.

He started receiving the fees in 2011, including a lump sum payment of more than $87,000 that boosted his total pay that year to more than $438,000.

Past efforts to reroute some of Ferdinand’s pay have failed.

Another try came in this year’s session, when Republicans introduced House Bill 346, which would make Fulton’s tax commissioner an appointed county official again in 2017, serving at the will of the County Commission. That bill stalled in the Senate but will be back in play next year.

IN-DEPTH COVERAGE

The Atlanta Journal-Constitution has uncovered problems stemming from the Fulton County Tax Commissioner’s Office’s sales of tax debts to private collection firms. Previous articles described how homeowners didn’t know they owed overdue taxes until their homes were being auctioned and they owed thousands of dollars in penalties and interest to settle small bills. Arthur Ferdinand has also taken heat for being the state’s highest-paid elected official through personal fees from tax collections in Atlanta, Sandy Springs and Johns Creek.

AJC WATCHDOG COVERAGE

The Atlanta Journal-Constitution has covered an array of issues involving the Fulton County Tax Commissioner’s Office’s sales of tax debts to private collection firms and how tax chief Arthur Ferdinand’s pay has come under scrutiny. This year, the AJC revealed how Ferdinand’s quick sales of delinquent tax bills, before the county collected a 10 percent penalty, handed as much as $20 million in potential revenues to Vesta Holdings, the biggest lien buyer, with a corresponding $20 million loss to taxpayers. The AJC also discovered that Ferdinand had dipped into his budget to buy a 2013 Ford Explorer Limited for $39,000, which he can use for his commute to work.

Another investigation, published Sunday, revealed that Ferdinand personally intervened after a tax debt owed by Atlanta Mayor Kasim Reed’s real estate holding company, Cascade Investors, was sold to Vesta. The Tax Commissioner’s Office got the debt transferred back to the county, then later filed documents asking the Superior Court Clerk to remove all liens filed against Cascade from the record.

--------------------------------------------------------------------------------------

AJC WATCHDOG

Reed dodges lien on late tax

Fulton tax chief ’s intervention departs from aggressive tactics.

By Shannon McCaffrey smcaffrey@ajc.com and Johnny Edwards jredwards@ajc.com

Atlanta Mayor Kasim Reed’s real estate investment company has been chronically late paying taxes on a vacant warehouse south of the city. And when one overdue bill got turned over to a collection firm, Fulton County Tax Commissioner Arthur Ferdinand — another prominent Democrat — intervened personally to return the debt to the county.

Ferdinand’s intervention, which spared Reed potential public embarrassment, runs counter to the aggressive tactics the tax office typically uses in selling liens on delinquent properties.

The chain of events, exclusively documented by The Atlanta Journal-Constitution through open records requests, left a bitter taste in the mouths of some who have battled with Ferdinand’s office over the years.

"It must be nice to have the ability to handle something like that without eight to 10 years of litigation," said attorney Frank X. Moore, who has represented more than a dozen property owners pitted against debt buyers and the county tax office. "I would say, it sure pays to have friends in power." Reed’s lawyer, Robert High-smith, denied that Ferdinand gave Reed special treatment. "He didn’t make an exception," Highsmith said. "If the tax commissioner had not agreed with us (that the debt was sold in error), they would not have withdrawn the lien."

Neither Reed nor Ferdinand consented to the AJC’s requests for interviews. Reed’s representatives pointed out that the company is now current on its tax bills.

His camp reiterated what Ferdinand himself had said in legal filings: that the lien should never have been sold, because the mayor’s company had already paid the taxes.

However, on that and other crucial points, their explanations do not square with records obtained by the AJC. The check for the tax bill was dated months after Ferdinand’s office bought the debt back from the collection company.

An investment that stalled

Reed’s tax problem had its roots in 2006, when he formed Cascade Investors with four other men to purchase property near his home in the southwest corner of the city. Reed was listed as managing member of the investment group until 2012, according to personal financial disclosures filed with the state and city.

According to the mayor’s spokeswoman, Sonji Jacobs, the partners also include Atlanta lawyers Lawrence and Robbie Ashe, father and son, respectively, of former Democratic state Rep. Kathy Ashe. The other partners are Aldrin Davis, a rap artist and producer better known as D J Toomp, and Darrell Anderson, a longtime friend of Reed who owns a limousine company. Reed has a 20 percent stake in the property.

At a foreclosure auction in November 2006, Cascade bought a vacant warehouse on Fairburn Road, paying about $1 million. Seven months later the partnership purchased a 3.5-acre wooded parcel adjacent to the warehouse for another $425,000. Both properties lie in unincorporated Fulton County, a stone’s throw from the Atlanta city line.

The plan, Anderson said in an interview with the AJC, was to create retail space and loft apartments, akin to the development taking place on the north side of the city.

"We wanted to do something and create investment on the south side, where there wasn’t anything of that level going on," Anderson said.

But their timing was off. The real estate collapse in 2007 stalled their plans, Anderson said, perhaps indefinitely. The warehouse sits empty. And since 2006, county records show that Cascade has repeatedly been late in paying its taxes, ultimately paying $15,000 in interest and penalties as a result.

Ferdinand takes a hand

During the 2009 mayor’s race, rival Mary Norwood blasted Reed’s failure to pay taxes on time. Reed narrowly beat Norwood.

When he became mayor in January 2010, Cascade Investors owed about $16,000 in overdue 2009 taxes.

Records show that in May 2010, the tax commissioners’ office sold that debt to Vesta Holdings, the county’s biggest buyer of tax liens. Vesta could have eventually auctioned off the warehouse to settle the account.

A week after the debt was sold, Ferdinand’s administrator of delinquent taxes, Terry Noble, sent an email to Richard Robinson of Vesta.

"Based on my conversation with Dr. Ferdinand," Noble said, "I am requesting that you transfer the referenced parcel... back to to Fulton County as soon as possible."

Reed’s lawyer, Highsmith, told the AJC that he did contact the tax office on behalf of Cascade, seeking to have the lien reversed. But he said no political favoritism was involved, because he did not mention that Reed was among Cascade’s partners.

Subsequently, the AJC obtained a letter, written by High-smith, indicating that Ferdinand already knew of Reed’s involvement. That’s because Reed himself had previously spoken to Ferdinand about Cas cade’s tax troubles.

According to the letter, Reed met with the tax commissioner in April 2010, seeking to clear up confusion over the address to which the tax bills should be mailed.

Queried about that meeting, Jacobs, the mayor’s spokeswoman, portrayed it as accidental, not an attempt by the mayor to involve Ferdinand in resolving Cascade’s tax delinquency.

"Mayor Reed checked on his tax records," she told the AJC in an email, "and like any other citizen might do, went to the office in person. When folks heard he was in the building, they apparently told Mr. Ferdinand, who came out to speak with him."

Jacobs said Cascade failed to pay the 2009 bill because it was sent to the wrong address: the midtown Atlanta law firm Holland and Knight, where Reed was a partner before becoming mayor.

Highsmith is the firm’s executive partner. As recently as 2012, he said in a letter to Ferdinand that the firm represents Cascade Investors in tax matters.

Jacobs said Reed had tried multiple times to change the address. However, the Tax Assessor’s Office, which is separate from Ferdinand’s office, and which maintains the address files, told the AJC it has no record of any attempt by Cascade to change where its mail was sent before 2012.

Highsmith also blamed a mailing mix-up for Cascade’s problems. He said the partnership never received a legally-required notice before the county filed a lien against its property, and that’s why the Tax Commissioner’s Office had to undo the lien.

But records in Ferdinand’s office show a notice was generated well in advance. The AJC obtained a copy, and it bore Holland and Knight’s address.

It is not uncommon for property owners whose tax liens are sold by Ferdinand to claim they were not properly notified; Ferdinand’s policy in such cases is to tell the taxpayers to resolve the matter by satisfying the debt with the firm that bought it.

One more twist

In 2012, two years after his initial involvement, Ferdinand took another action that benefited Reed. He filed a document saying the county had erred in placing a tax claim against the warehouse in the first place. And he instructed the Superior Court Clerk to remove the lien from the record.

A stamp on the document said the lien was issued through "inadvertence," and that "payment processed before lien was filed."

But Cascade’s check was dated months after the county bought back the debt from Vesta.

In response to questions about the apparent discrepancy, Highsmith said Cascade had tried earlier to pay the taxes with a cashier’s check. No such check turned up in an open records request to the tax office for all checks received from Cascade, dating back to 2006.

Highsmith said he could produce a copy for the AJC, but he did not.

Ferdinand also nullified the only other two claims ever placed against Cascade’s properties despite years of late taxes, according to Superior Court records. The tax chief filed documents telling the clerk to remove both a lien for 2009 taxes against the wooded parcel and a lien for 2011 taxes against the warehouse because of "address change" issues.

Those who have tussled with Vesta and Ferdinand’s office over the years were livid to hear of Reed’s treatment. Moore, the attorney, said some of his clients have been held to a different standard despite having far better excuses for not receiving notice of taxes or liens.

One such client was Rita James, a grandmother in her 70s, who nearly lost her home because of a billing error.

After James paid off her mortgage, Moore said, she paid the tax bills that came to her house in her name.

But her house straddles two subdivision lots. Another bill, as well as notices of overdue taxes and notices of the lien sale, apparently went to Archie James, a person the woman had never heard of, at an address that does not exist.

Ferdinand’s office issued a lien, then sold the debt to Vesta, which auctioned the parcel. The winning bidder put a claim against James, and she had to hire Moore and take the matter to court to keep her home. Last year Ferdinand’s office placed two liens against Mark Scott’s Buckhead house when he was three and two months late paying his city and county tax bills. A Vesta company bought the liens.

Scott paid $34,650 to settle up. He acknowledges that he was at fault, but he said he wishes he’d had the privilege of dealing with the county instead of Vesta. Taxpayers have long complained that Vesta makes little effort to inform them of debts and can be difficult to contact when they try to pay them off.

"It’s flat-out wrong," Scott said of the way Reed’s firm was treated. "You need to be held to the same standard as the people that are paying your salary."

A vacant warehouse sits fenced off along Fairburn Road in Fulton County. Records show that property taxes on the warehouse, owned by an investment company managed by Atlanta Mayor Kasim Reed, have been habitually paid late. KENT D. JOHNSON / KDJOHNSON@AJC.COM

Atlanta Mayor Kasim Reed did not seek special treatment from the Fulton County tax commissioner, the mayor’s spokeswoman says. HYOSUB SHIN / HSHIN@AJC.COM

HOW WE GOT THE STORY

With Atlanta Mayor Kasim Reed seeking a second term, Atlanta Journal-Constitution reporter Shannon McCaffrey decided re-examine his financial records and real estate holdings, discovering that the mayor’s real estate holding company, Cascade Investors, had a history of paying taxes late. Meanwhile, AJC reporter Johnny Edwards had been scrutinizing the collection practices of Fulton County Tax Commissioner Arthur Ferininand, having recently exposed how he personally profits from the sale of tax liens to private investors.

The reporters discovered an email, obtained through an open records request, that brought the two issues together. In June 2010, Ferdinand’s delinquent tax administrator, Terry Noble, sent an email to Richard Robinson of Vesta Holdings, seeking the return of a lien worth $18,500 against Cascade’s warehouse on Fairburn Road. Noble said he’d had a"conversation with Dr. Ferdinand"about the matter.

Intrigued, McCaffrey and Edwards pored through online tax records and lien records filed with the Fulton County Superior Court Clerk. They also filed open records requests for checks used to pay taxes on the property, discovering that — contrary to a court filing by Ferdinand — Reed’s company actually paid eight months late. Attempts to interview Ferdinand and Reed about the matter were fruitless, and Reed’s camp offered a shifting narrative that didn’t hold up to scrutiny.

For example, Reed’s representatives said he never received notice that the county planned to file a lien against the property because the county failed to process a change-of-address request. However, the Tax Assessors Office says tax mailings went to Reed’s attorney’s office from 2007 to 2011.

Also, Reed’s attorney said he contacted the Tax Commissioner’s Office seeking reversal of the lien, and that he never dropped the mayor’s name. However, the reporters obtained a letter, written by Reed’s attorney, saying that Reed and Ferdinand had met in April 2010 to discuss Cascade’s tax account.

TIMELINE

November 2006: Kasim Reed creates Cascade Investors LLC, a real estate holding company. Cascade purchases a 38,156-square-foot warehouse in southwest Fulton County for $1 million at a foreclosure auction.

July 2007: Cascade Investors purchases another 3-acre parcel adjacent to the warehouse for $425,000.

December 2009: Reed elected mayor of Atlanta.

March 12, 2010: Fulton County Tax Commissioner Arthur Ferdinand places a lien against the warehouse property for a $16,392. The bill, at this point, is almost three months late.

April 2010: Ferdinand and Reed meet personally to talk about Cascade’s tax account, according to a letter written by Reed’s attorney.The newly elected mayor, the letter says, asked for an address change, and Ferdinand told him to take that up with the Tax Assessor’s Office.

May 26, 2010: Vesta Holdings buys the warehouse lien from Ferdinand.

June 2, 2010: Ferdinand’s delinquent tax administrator, Terry Noble, sends an email to Richard Robinson of Vesta Holdings saying,"Based on my conversation with Dr. Ferdinand, I am requesting that you transfer the referenced parcel (2009 FUL cycle) back to Fulton County as soon as possible." Aug. 10, 2010: Cascade Investors issues a check totalling $25,147 to Ferdinand for the 2009 taxes, interest and penalties on the warehouse, as well as for most of the 2009 taxes on the adjacent lot.

February 24, 2012: Ferdinand’s office files another copy of the warehouse lien with a message saying it was filed in error because payment had actually been received before the lien was originally filed.

March 12, 2012: Ferdinand’s office files copies of two other liens against Cascade’s properties for late-paid 2009 and 2011 taxes, again directing the Superior Court Clerk to remove them from the record because of"address change"issues. The letter from Reed’s attorney to Ferdinand referencing their April 2010 meeting is dated the same day, and adds, "We are grateful to your office for having the FiFa marked as having been issued in error."

August 2013: Reed announces he will seek a second term.

============================================================

9/1/13

Fulton County Tax Assessor Ferdinand remains in the news with new actions which will cost Fulton tax payers additional thousands of dollars to defend Ferdinand for acting out his private vendetta against a County Commissioner who is on his Nixionian 'Enemies List'.

A grand jury is needed to look into the relationship between Ferdinand and the firm he sells most of his tax liens to. Past time for the tax payers in Fulton to start making some noise.

The complicating factor here is that Ferdinand is BLACK and a Democrat, most other Black voters/taxpayers are not going to back any effort to look into a fellow Black and Democrat. This is just the way minorities act, they protect their own, but until a grand jury takes up the matter, Ferdinand will continue to line his pockets and run rough shod over anyone he perceives as an 'enemy'.

Just a minor comment on how these scandals generally break down:

If it's sex it's a Republican, if it's money it is a Democrat.

Summary: Arthur Ferdinand needs to go.

-------------------------------------------------------------------------------8/12/13

Liens a cash cow for Fulton tax chief http://gapundit.com/2013/08/12/liens-a-cash-cow-for-fulton-tax-chief-www-myajc-com/

Posted on August 12, 2013 5:45 AM by Todd Rehm

Seizing on a law on the books since the Great Depression, by 2010 Tax Commissioner Arthur Ferdinand had found a way to personally profit from the controversial collection system he set up.

Now, Ferdinand takes a cut every time his office sells a tax debt to a private collection firm or the taxpayer antes up, an investigation by The Atlanta Journal-Constitution has found. He already was Georgia’s highest-paid elected official, but a 50-cent fee he now gets on each and every paid-off lien has added tens of thousands a dollars a year to his pay.

With the boost, Ferdinand earned $383,000 last year for a job where he started out earning $77,400 in 1997.

Not even county commissioners knew how much he really makes, even though the fees were going into county coffers before they were diverted to Ferdinand’s pocket. He may be Georgia’s only tax commissioner taking that money.

Ferdinand wouldn’t discuss the payments, saying only that they are "permitted by law." And Fulton County’s lawyers have blessed the arrangement, though they will not explain their reasoning.

Other attorneys, though, are not so sure Ferdinand can legally take both a full salary and a slice of lien proceeds, and they say the arrangement creates a staggering conflict of interest. The tax commissioner, critics say, now has a profit motive to hurl more taxpayers into a system that can put them at risk of losing their homes over small debts.

No other tax commissioner in Georgia sells so many tax liens to private debt collectors. With each sale, Ferdinand hears cha-ching!

(Misc FYI: If you were going to a specific page and no longer find it, keep in mind that the site has been consolidated and to save space posts have been lumped together)

AJC WATCHDOG

Tax chief profits from selling others’ debts

When the housing crisis was squeezing Atlanta and many homeowners struggled to pay their property taxes, life was getting sweeter for Fulton County’s chief tax collector.

Seizing on a law on the books since the Great Depression, Tax Commissioner Arthur Ferdinand had found a way by 2010 to personally profit from the controversial collection system he set up.

Now, Ferdinand takes a cut every time his office sells a tax debt to a private collection firm or the taxpayer antes up, an investigation by The Atlanta Journal-Constitution has found. He already was Georgia’s highest-paid elected official, but a 50-cent fee he now gets on each and every paid-off lien has added tens of thousands of dollars a year to his pay.

Ferdinand wouldn’t discuss the payments, saying only that they are “permitted by law.” And Fulton County’s lawyers have blessed the arrangement, though they will not explain their reasoning.

No other tax commissioner in Georgia sells so many tax liens to private debt collectors. With each sale, Ferdinand hears cha-ching!

“This incentivizes him to pass your debt to a third-party collector,” said Hugh Wood, a partner with Wood & Meredith, a law firm that handles real estate litigation. “The tax commissioner now has two masters. Either he is serving himself, or he is serving the taxpayer.”

Ferdinand said of his motives in an email, “My intent is to make sure taxes are paid as quickly as possible.”

To questions about his personal profits and the potential conflict, Ferdinand’s only response was to cite the state law that the Fulton County Attorney’s Office said justified the payments — a law dating back at least to 1933, when most tax commissioners earned their pay through fees.

“Just because there is a law on the books that authorizes certain behavior,” state Rep. Lynne Riley, R-Johns Creek, said, “that doesn’t mean it’s ethically or morally the appropriate thing to do.”

Seizing a new cash stream

The lien fees Ferdinand is paid come on top of his six-figure county salary and on top of the $1-per-parcel fees he collects from Atlanta, Johns Creek and Sandy Springs for adding their city tax bills to county bills.

So far Ferdinand has been pocketing roughly $22,000 to $31,000 extra per year from the lien fees. The county doesn’t give rank-and-file employees in Ferdinand’s office, who do the paperwork and average about $35,000 per year in pay, a portion of the extra compensation.

The payments came to light through earning statements and other documents the county turned over to the AJC in response to open records requests.

An interoffice memo shows Ferdinand began seeking the money in 2010, citing the old state law. He initially wanted back payments for about 365,000 liens paid off since 2002.

“At your earliest convenience,” he wrote to Finance Director Patrick O’Connor on Nov.10, “please issue a check in the name of Arthur E. Ferdinand for the full amount of $182,492, in accordance with State Law.”

O’Connor and his staff turned to Fulton County’s law department for advice, emails show.

The County Attorney’s Office issued a legal ruling saying Ferdinand had a right to the money, Assistant Finance Director Sharon Whitmore told the AJC. The county would agree to go back only to July 2007 with retroactive payments, she said, so in 2011 Ferdinand received a lump sum payment of more than $87,000.

There was no public discussion of the change, and county commissioners, who set Ferdinand’s budget, say they weren’t aware of it until contacted by the newspaper.

When most tax commissioners began receiving salaries, local legislation forbade them from still keeping fees, too, Dan Ray said. In Rockdale County, where he formerly served as tax chief before leading GATO, county code specifies that.

Tax commissioners in Cobb and Gwinnett are paid a salary and the lien fees go to their counties, not to them. DeKalb Tax Commissioner Claudia Lawson earns personal fees for billing nine cities’ taxes — earning nearly $237,000 last year including her salary — but gets nothing extra when liens are paid off.

Not even Haralson County Tax Commissioner Barbara Ridley, who still relies on commissions from tax collections and motor vehicle fees for her pay, keeps the 50-cent lien fees.

The law department won’t release its opinion to the AJC, citing attorney-client privilege.

Wood, the real estate attorney, said he is not convinced Fulton County is on solid legal ground in routing the funds to Ferdinand. His research turned up contradicting case law and state Attorney General’s Office opinions from decades ago, and he finds it troublesome that Fulton’s tax chief is operating unlike any of his Georgia counterparts.

Several North Fulton state lawmakers, though, were livid upon being informed of the profits from liens. They called Ferdinand’s position audacious, considering that he already earns more than twice as much as Gov. Nathan Deal.

“That’s outrageous,” said state House Speaker Pro Tem Jan Jones, R-Milton, who had to pay the county’s biggest lien buyer — Vesta Holdings — $105 to satisfy a lien against her home in 2011. “He has a built-in incentive to slap a lien before a taxpayer has had adequate notice to clean up a mistake, even.”

Jones and state Rep. Wendell Willard, who chairs the House Judiciary Committee, said they would work to overturn the state law Ferdinand is using to justify the payments and expressed hope the revelations will attract support for a bill targeting Ferdinand that stalled in the Senate earlier this year.

Each year, Georgia tax chiefs meet at the state’s top resorts for a conference that allows time to golf and hobnob with vendors. Picking up the tab are taxpayers and companies seeking contracts, an AJC investigation found.

About this story

A series of investigations by The Atlanta Journal-Constitution this year has spotlighted concerns about operations of the Fulton County Tax Commissioner’s Office. Among the stories, the AJC reported in February that Tax Commissioner Arthur Ferdinand’s quick sales of delinquent tax bills, before the county collected a 10 percent penalty, handed as much as $20 million in potential profits to Vesta Holdings, the biggest lien buyer, with a corresponding $20 million loss to taxpayers.

In April, another investigation showed how savvy investors use tax liens to short-circuit legal safeguards and quickly snatch homes away from taxpayers who get behind on bills, sometimes for a fraction of the properties’values.

For this story, Fulton County reporter Johnny Edwards used the Georgia Open Records Act to pore through hundreds of pages of documents showing Ferdinand’s compensation and expense reimbursements. Among them were income tax forms revealing that the tax commissioner, the state’s highest-paid elected official, has been earning even more money than previously reported.

Edwards examined campaign finance disclosure statements and property tax records. And with assistance from database reporter Jeff Ernsthausen, he used a tax lien database that the AJC obtained after a two-year open records battle with Ferdinand and the county.

--------------------------------------------------------------------------------

Tax commissioner’s expenses out of line with county’s budget

picture

By Johnny

Edwards jredwards@ajc.com

While using his position and legal loopholes to earn nearly as

much as the U.S. president, Fulton County Tax Commissioner Arthur Ferdinand has

also reaped myriad perks from his office.

He has soaked up luxuries at taxpayer

expense, an Atlanta Journal-Constitution investigation found. Ferdinand also

leaps at nickels and dimes, even pocketing county money as reimbursement for

expenses he may not have had.

“If he can find a way to squeeze another dime

away from the Fulton County taxpayer, he’s going to do it,” said

Atlanta-based tax activist R.J. Morris, who ran unsuccessfully against

Ferdinand last year, “and

nobody’s going

to do anything about it because they’re scared of him.”

Financial documents show that during the roughest years of the Great Recession, when other county offices were scrambling to cut expenses, the tax commissioner took his five highest-paid staffers to lake-front luxury lodges for their “budget planning” sessions. Taxpayers picked up hotel bills of as much as $295 per night for each person.

When Ferdinand has taken unidentified

individuals for what his expense reports list as “business lunches,” the county

has repeatedly paid his tab. Lunches for two at the restaurants he frequents —

The Commerce Club and Legal Sea Foods downtown and Chops Lobster Bar in

Buckhead — have cost from $47 to $86.

Car washes for his county-funded, take-home

vehicles have cost $11 to $25. His latest vehicle, a 2013 Ford Explorer, cost

taxpayers $39,000.

For years, when he went to out-of-town

conferences, he collected daily meal allowances from the county — even though

many meals were already included in registration costs. County policy forbids

such double dipping.

Meanwhile, at county expense, he showed up for conferences on Sundays, a day early, when the only items on the Monday agendas were golf and evening receptions.

“My goodness, it never ends,” state Rep. Wendell Willard, a Sandy Springs city attorney who has tangled with Ferdinand over the years. “This guy will find every possible way to milk the taxpayers.”

Ferdinand declined an interview request but answered some questions sent to him in writing. On the staff budget-planning overnight trips, he said, “Our planning sessions are justified based upon the financial results they deliver.”

As to why he collected the county meal per diem for conferences where many meals were provided, Ferdinand said, “County policy also allows for employees to eat outside of the conferences when the meals served are not suitable to the individual’s dietary needs.”

He did not respond to questions about whether he had any such needs. The policy the AJC obtained from the county Finance Department doesn’t list such an exception.

Assistant Finance Director Sharon Whitmore said in an email that it has been an administrative practice to allow for outside meals if someone submits a doctor’s letter and gets approval from the county manager. She said, through a spokeswoman, she was not aware of any such letter from Ferdinand.

Regardless, he told the organizers of the 2009 Georgia Association of Tax Officials conference that he didn’t have any food issues. The registration form asked, “Special dietary re strictions?” He checked “no.”